Software

We keep up with all the latest in software developments

We keep up with all the latest in software developments

We try and understand where computers came from

We try and understand where computer tech is headed

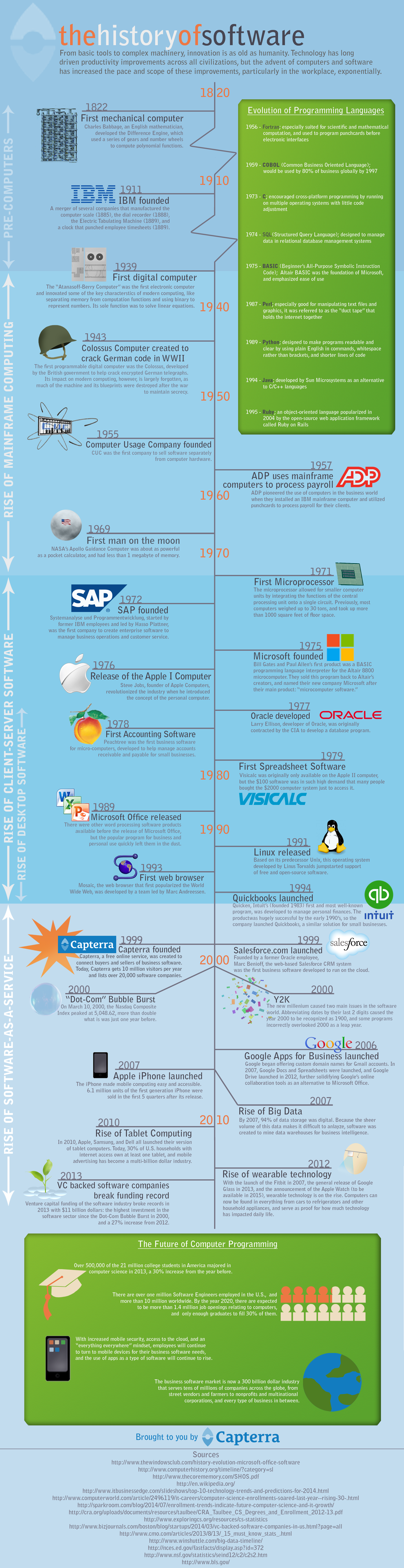

To know where computers are going in the future (including software) we need to understand where it came from in the first place.

We spend the majority of our days using computers at work, smartphones when we are outside and about and tablet computers and PCs in the home. Technology, especially applications, is now such an essential part of the work and everyday life, it’s tough to remember a world without it. In actuality, finding a world without computers may be more difficult than you think; they’ve existed now for decades.

On the eve of the software industry’s 60th birthday, and also to commemorate Capterra’s 15th anniversary of helping companies find the perfect applications, we decided to have a look back on this History of Software and find the most essential and most forgotten-about events which impacted the business. Have a look at our deadline: are there some significant milestones that we did not include? Where could your company fit into this background?

With the software business continues to grow, we believe there’s a good deal of future history to be made!